Welcome Home Website

images credit : google

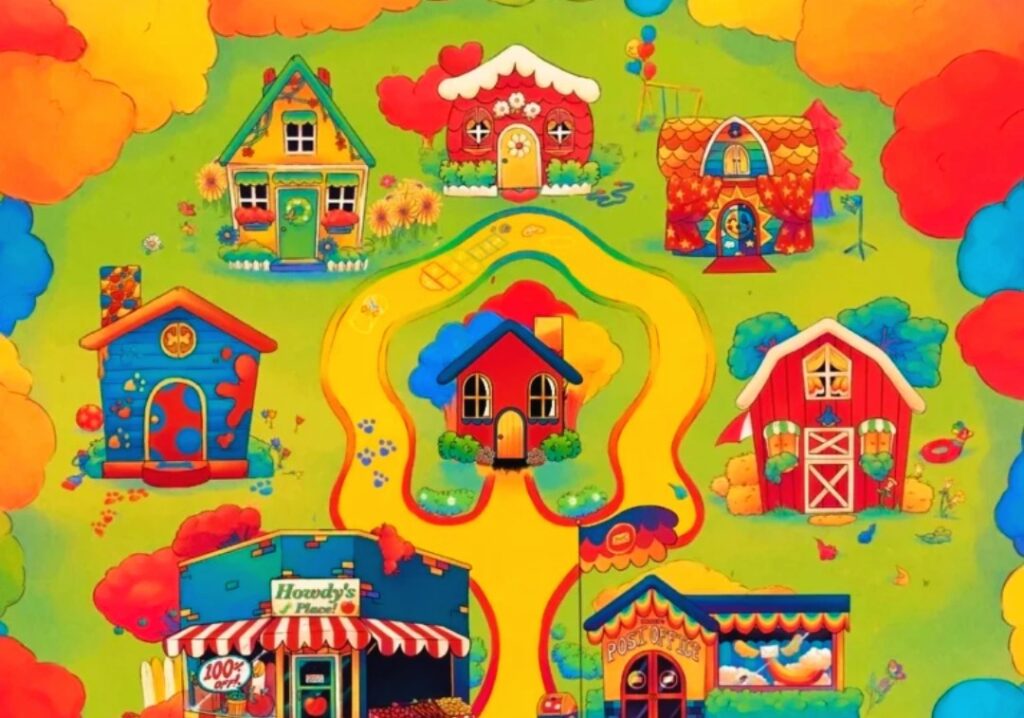

Welcome Home is a fictional puppet show that has been making waves online in recent months.The show is said to have aired in the 1970s, but no footage of it has ever been found.However, a number of people have come forward claiming to have memories of the show, and there is a growing online community dedicated to uncovering its secrets.

Home Insurance

Your home is likely one of your most valuable assets. It’s where you raise your family, relax after a long day, and create lasting memories.Home insurance helps safeguard this investment against unexpected events that can cause significant financial hardship.This article dives into the world of home insurance, explaining its different types, coverages, and factors to consider when choosing a policy.

What is Home Insurance?

Home insurance, also known as property insurance, is a financial safety net that protects your dwelling and its contents from various perils. These perils can be broadly categorized into natural disasters like fire, earthquakes, and floods, or man-made events like theft, vandalism, and explosions.

| Coverage Type | Description |

|---|---|

| Dwelling Coverage | Protects the physical structure of your home. |

| Contents Coverage | Covers your belongings inside the home. |

| Combined Coverage | Combines dwelling and contents coverage into a single policy. |

| Condo Insurance | Tailored for condominium owners, covering their unit and common areas. |

| Renters Insurance | Protects renters from financial losses due to theft, damage, or additional living expenses. |

| Additional Living Expenses | Covers temporary housing costs if your home is unlivable due to a covered peril. |

| Personal Liability | Protects from lawsuits if someone gets injured or their property is damaged on your property. |

Contents

Types of Home Insurance Policies

There are various home insurance policies available, each catering to different needs and budgets. Here’s a breakdown of some common ones:

• Dwelling Coverage: This covers the physical structure of your home, including walls, roof, foundation, and permanently attached fixtures.

• Contents Coverage: This protects your belongings inside the home, such as furniture, electronics, clothing, and appliances.

• Combined Coverage: This policy combines dwelling and contents coverage into a single policy, often at a discounted rate.

• Condo Insurance: This is tailored for condominium owners, covering the interior of their unit and their share of the building’s common areas.

• Renters Insurance: This protects renters from financial losses due to theft, damage to their belongings, or even additional living expenses if the property becomes uninhabitable.

What Does Home Insurance Cover?

A standard home insurance policy typically covers the following:

• Dwelling damage: Repairs or rebuilds due to covered perils like fire, lightning, hail, explosions, windstorms, and vandalism.

• Loss or damage to contents: Reimbursement for stolen or damaged belongings due to covered events.

• Additional living expenses: Covers temporary housing costs if your home becomes unlivable due to a covered peril.

• Personal liability: Protection from lawsuits if someone gets injured or their property is damaged on your property.

Factors to Consider When Choosing Home Insurance

• Replacement value of your home and belongings: Ensure your coverage is enough to rebuild your home and replace your possessions in case of a total loss.

• Your deductible: This is the amount you pay out of pocket before the insurance company kicks in. A higher deductible lowers your premium, but you’ll shoulder more cost initially in case of a claim.

• Risks in your area: Consider the frequency of natural disasters or crime rates in your location when choosing your coverage options.

• Additional coverages: You might want to consider add-ons like flood insurance or earthquake insurance depending on your specific risks.

• Discounts: Many insurers offer discounts for things like bundling home and auto insurance, having security systems, or being a claims-free customer.

Getting Home Insurance

• Compare quotes: Obtain quotes from multiple insurance companies to compare coverage and pricing.

• Work with an insurance agent: An agent can help you understand different policies and find the one that best suits your needs.

• Read the fine print: Carefully review your policy documents to understand what’s covered, exclusions, and the claims process.

By investing in home insurance, you gain peace of mind knowing that your haven is financially protected. With the right coverage in place, you can focus on rebuilding your life and recovering from unforeseen circumstances.

Related Terms

• home insurance quotes

• progressive home insurance

• home owners insurance

• geico home insurance

• home insurance companies

• home insurance near me

• home owner insurance

• best home insurance

• home insurance quote

What is homeowners insurance?

Homeowners insurance is a type of property insurance that protects your home and belongings in case of damage or loss. It can cover a wide range of events, such as fire, theft, vandalism, severe weather, and even liability if someone gets injured on your property.

What does homeowners insurance typically cover?

There are different types of homeowners insurance policies, but most commonly they cover:

- Dwelling coverage: This protects the structure of your home, including walls, roof, and attached structures like a garage.

- Personal property coverage: This covers your belongings inside your home, such as furniture, appliances, and clothing.

- Liability coverage: This protects you if someone gets injured or their property is damaged on your property, and you are found legally responsible.

- Additional living expenses: This may cover costs like hotel bills and meals if your home is uninhabitable due to a covered event.

How much does homeowners insurance cost?

The cost of homeowners insurance varies depending on a number of factors, such as:

- The value of your home

- Your location

- The type of coverage you choose

- Your deductible (the amount you pay out of pocket before your insurance kicks in)

What are the different types of homeowners insurance?

There are several different types of homeowners insurance policies available, each with its own coverage options. The most common types are:

- HO-3: This is the most common type of homeowners insurance and covers a wide range of perils (events that can damage your home).

- HO-5: This is a comprehensive policy that covers all perils except for those specifically excluded.

- HO-6: This is a policy designed for condo owners.

Do I need homeowners insurance?

If you have a mortgage on your home, your lender will likely require you to have homeowners insurance. However, even if you don’t have a mortgage, it’s still a good idea to have homeowners insurance to protect your investment.

How can I get homeowners insurance?

You can get homeowners insurance from a variety of insurance companies. It’s a good idea to shop around and compare rates from different companies before you buy a policy.

Remember, it’s important to read your homeowners insurance policy carefully so you understand exactly what is and is not covered. You may also want to talk to an insurance agent to make sure you have the right amount of coverage for your needs.

Welcome Home website secrets,When will the Welcome Home website be back,Welcome Home website wiki,What happened to the Welcome Home website,Welcome Home website down,Clown illustration Welcome Home website,Welcome Home map,Welcome Home AUs,clownillustration.com welcome home,Welcome Home characters names,Welcome Home boundaries,Welcome Home video Game,Welcome home website update today,Welcome home website update reddit,Welcome Home ARG official website,When will the Welcome Home website be back,Welcome Home website codes,Welcome Home wiki,Welcome home website secrets reddit,Welcome home website secrets codes,Welcome Home updates,Welcome Home safe,Welcome Home ARG website link,Welcome Home safe code,Welcome home website arg reddit,Welcome Home ARG website codes,What happened to the Welcome Home website,Clown illustration Welcome Home website,clownillustration.com welcome home,Welcome Home ARG game